Battery R&D to limit EV range anxiety

BY TERRY MARTIN | 13th Aug 2010

As new research has emerged from the US showing range anxiety as one of the biggest barriers to mass adoption of EVs, former Tesla Motors co-founder and now VW’s EV engineering director Martin Eberhard believes the rapid pace of development should give EVs an operational range akin to conventional-engine vehicles – before the decade is out.

“At the current rate of progress, I’d say we will have banished the range anxiety problem, and will be making EVs with greater than 500 miles (804km) of operational range, within 10 years,” Mr Eberhard told Britain’s Autocar. “At that point, the further development of fast-charging infrastructure won’t be so important – because how often do you drive more than 500 miles in a day?”Based at the Volkswagen Group’s Electronics Research Laboratory in California, Mr Eberhard is working on the development of power electronics and battery systems for the European auto giant’s forthcoming EVs, which will be a critical part of the company’s quest to become the world’s number-one car-maker by 2018.

Mr Eberhard told Autocar that he was developing the lithium-ion battery packs for VW’s electric Golf, the E-Up city car and Audi’s e-Tron electric car family.

He said the batteries in these vehicles all used ‘18650’-type lithium-ion cells – also known as ‘consumer’ cells for their prevalent use in laptop computers – and were constantly improving, given their widespread application which made them the subject of massive R&D expenditure.

“To illustrate the point, the lithium-ion cells we’re currently working with contain 2.9 amp-hours of power – five years ago the ones we were using at Tesla only had 1.4 amp-hours,” Mr Eberhard said.

“That rate of development has already had an impact on the cars we’re working on. The batteries we used in the original Audi e-Tron prototype, for example, gave it 60kWh of power and a range of just over 150 miles (241km).

“But with the 3.4 amp-hour cells we’re about to take delivery of, it should have 100kWh and do close to 300 miles (483km) on a charge.”This phenomenal rate of progress will have significant ramifications on the development programs of the world’s major car-makers, all of which are developing pure electric vehicles and/or plug-in hybrid cars.

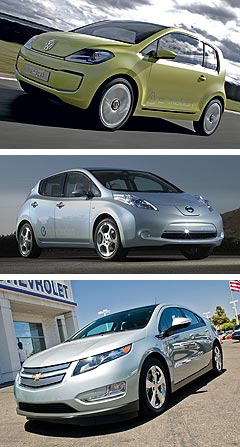

It could force the first generation of EVs, which have an extremely limited range, to be upgraded with higher performance batteries much earlier than expected, while those who are investing heavily in range-extending plug-in hybrids – such as GM with the Chevrolet/Holden Volt and related vehicles – might be required to place greater emphasis on pure EVs.

The key will be consumer acceptance, and in a comprehensive study just released on EV mass adoption in the US, consulting firm Deloitte has identified anxiety over battery performance as a major issue, despite the fact that an 80-160km range would meet the daily driving requirements of most people.

While 32 per cent of survey respondents identified the higher cost of EVs as the main factor preventing them from purchasing such a vehicle – making it the key barrier – 22 per cent said the limited range of EVs was key for them, placing it as the second most significant limiting factor.

Deloitte also interviewed executives from major car-makers, clean-tech start-ups, dealers and energy companies and, combining this quantitative data with qualitative results from consumers, identified six potential barriers to the mass adoption of EVs: range, familiarity, brand, charging, infrastructure, and price and cost of ownership.

In a similar way that Australians love SUVs for their 4WD capabilities, even though they might never travel off-road, Deloitte found that even though EVs meet the daily range requirements of most American drivers, range anxiety remained a significant issue.

Key among its findings was that 70 per cent of drivers surveyed expected an EV to travel 300 miles – well in excess of any EVs currently available – before they would consider purchasing one.

Deloitte said: “Technically a 50-100 mile electric range would meet the daily driving requirements of most customers, a statistic that clean-tech executives focus on. But our research indicates that consumers aren’t comfortable with that range. Most expect a minimum range of 300 miles before they would consider an EV.

“Essentially, consumers want the equivalent range of an ICE (internal combustion engine) vehicle on a tank of gas (petrol). This gap is important: customers want the freedom and convenience they associate with a full tank of gas. They want the convenience and peace of mind knowing they can make from point A to point B without the worry of running out of fuel or energy.”While American consumers are well accustomed to hybrid vehicles, which now have around a 2.3 per cent market share in the massive US market, Deloitte’s research shows people as being largely unfamiliar with other alternative fuel technologies.

With EVs representing an even more radical departure from conventional vehicles than hybrids, Deloitte says public acceptance will require “more education about issues such as charging, ranges and the driving experience itself” and will cost more than the $US1 billion-plus spent on hybrids over the past 10 years.

Another key issue is brand, which drives most vehicle purchases and which Deloitte says will be critical with EVs. Its study indicates that Toyota, Honda and Ford have brand “permission” in this area, due in part to the “green equity” they have built with hybrids.

“We think that EVs from these three OEMs will have the highest likelihood of success,” Deloitte said. “As a corollary, Nissan and Chevrolet will likely face challenges in their upcoming EV launches. As first-to-market products, their vehicles will bear the cost and burden of educating consumers.”As with all vehicle purchases, price is also identified as probably the greatest factor driving or preventing mass adoption of EVs in the US.

While 69 per cent of consumers surveyed consider price the most important factor in a vehicle purchase, most of them (23 per cent) expect to pay less than $US30,000 for an EV.

Based on its research, Deloitte estimates that in 2020 electric vehicles will account for 3.1 per cent of total automotive sales in the US market, or approximately 465,000 units.

It also expects a large number of manufacturers to be competing in this space, which will in turn shrink the market share for each car-maker.

“Assuming five OEMs in 2015 making electric vehicles, each OEM will sell only 12,000 units a year on an average,” Deloitte said. “This volume does not appear to be sufficient to push the cost of the battery lower.

“In 2020, even with the volume at 465,000 units, each OEM will have only about 93,000 units. If each of the five OEMs has three models, then EV production per model will be only 30,000.

“At this small volume, OEMs will be challenged in recovering the cost of their infrastructure investments, and each OEM will face significant cost pressures.”