Make / Model Search

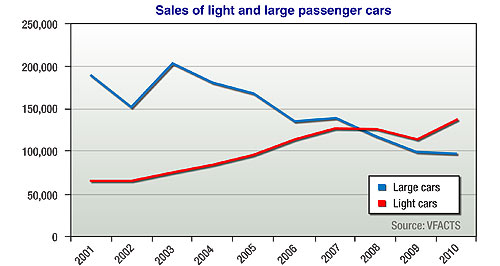

News - Market Insight - Market Insight 2011Aussie motorists see the lightLight me up: Runabouts like Suzuki's sub-$12,000 Alto are attracting buyers who might have otherwise gone for a used car. Trend to light cars continued in 2010, despite stable fuel prices11 Jan 2011 THE smallest cars on the market packed a big punch in 2010, with so-called light cars leading the growth of passenger car sales as the motor industry completed its comeback from the global financial crisis. Booming SUVs – particularly the compact variety – set the pace with 25 per cent growth in sales in 2010, but passenger car sales generally lagged, growing 9.5 per cent compared with the overall market’s 10.5 per cent lift. But that flat performance by the passenger car segment would have been worse if it had not been for light car sales, which surged 18.4 per cent over 2009 levels. This is despite relatively steady fuel prices and a growing economy – two factors that usually encourage buyers to drift back to bigger, thirstier cars until the going gets tough again. Clearly, Australians have a growing appetite for light cars – an appetite that could soar to near-European levels in the event of a new fuel spike such as the one experienced globally in 2008.  From top: Holden Barina Spark, Nissan Micra, Chery J1, Geely MK. From top: Holden Barina Spark, Nissan Micra, Chery J1, Geely MK.This light-car boom has been largely driven by a wealth of new-generation models that not only offer an unprecedented level of comfort and performance that were once the province of large cars, but also prices that have never been lower, not just in relative historical or adjusted value terms but in simple dollars. When was the last time a new car could be had for $11,790, complete with airbags, ABS and ESC? The current Suzuki Alto is one such car. The strong Aussie dollar and record-low tariff levels – down to zero for cars imported from Thailand – have helped. In the past 10 years, light car sales in Australia have more than doubled, up 106 per cent from 66,942 vehicles in 2001 to 137,916 in 2010. By comparison, sales in the one-size-larger small-car segment – for several years the largest in the industry – have grown a 47.5 per cent in the same timeframe, from 162,046 units to 239,191 today. Last year, small cars, which include the top-selling Toyota Corolla, Mazda3, Hyundai i30 and Holden Cruze, could manage a sales gain of only 11.8 per cent – just ahead of the market in general. The once-dominant large-car market segment, led by the Holden Commodore, was the only passenger car segment to lose ground last year, down 3.1 per cent. Since 2001, large car sales have almost halved – down 48 per cent from 190,303 vehicles to 98,583 units. While large cars are more affordable than ever, too, many light cars sold at the budget end of the spectrum are used-car substitutes, snapped up by Gen Y buyers used to shiny new products (not someone else’s problems), Gen Xs looking for a second family runabout and Baby Boomers amazed at the value when it comes time to downsize. Although these buyers find a bewildering variety to choose from, the number of contenders in the light car segment has actually declined in the past decade, down from 23 models in 2001 to 21 in 2010. This year, however, that figure is expected to jump with the arrival of the first wave in what is expected to be the new driver in the class: Chinese cars. At least two Chinese companies – Geely and Chery – have plans to introduce new light cars on to the Australia market in 2011, and while no one is saying they will take the market by storm, every motor company from Toyota down is keeping a careful eye on the development. If nothing else, they will serve to keep prices in check, just as the South Korean entries did in the 1980s. Yes, the established car-makers will be able to charge a premium over the new kids on the block, but only so much in this, the most price sensitive area of the market. While the light-car market segment has grown over the past few years, it has also developed into what could be described as two separate classes: the full-sized light car as represented by models such as the Yaris, Holden Barina and Volkswagen Polo, and the city runabouts – the Alto, Nissan Micra and Barina Spark. The latter is developing into one of the hot new battlegrounds, with many car companies either locking in such models or putting out feelers to head office about sourcing a model. Hyundai, who has just lost its top-selling Hyundai Getz that has come to the end of its long and distinguished life, is eying the similarly sized i10 baby car, while Toyota has a new sub-Yaris model under consideration. The result is a two-pronged approach for most of the major car companies, in the mould of Holden’s Barina/Barina Spark strategy. And they won’t necessarily be smaller, with some these cars simply cheaper due to a combination of lower levels of technology based on amortised designs and cheaper manufacturing sources. A good example of this could be the Ford Figo, which is based on the superseded Ford Fiesta and made in India (with another version set to go into production in China). Apart from India, China looms as the next big source of such cars as the world’s biggest market gets on top of quality and supply requirements. All of the world’s major car companies are already operating in China, and while the hungry Chinese market is gobbling up every car they and their Chinese partner companies can make right now, it is only a matter of time before they turn their eyes west, perhaps prompted by mooted restrictions of domestic car market growth in that country. One thing is for sure, we haven’t seen the end of light car action yet.  Read more |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

Facebook Twitter Instagram