Make / Model Search

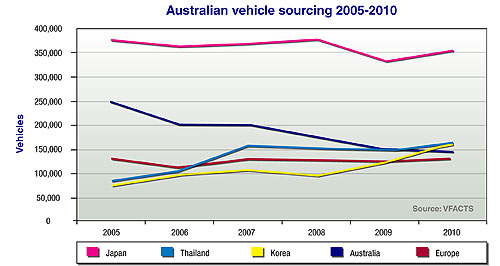

News - Market Insight - Market Insight 2011Domestic production eclipsed by Asian imports in 2010Win or Cruze: Shifting Holden’s Cruze production from South Korea to Australia should help local manufacturing regain lost ground. Australia knocked from vehicle sourcing second spot by both Thailand and South Korea1 Feb 2011 THE number of locally-produced vehicles supplied to the Australian market was simultaneously overtaken by imports from Thailand and South Korea last year, demoting domestic production from second to fourth largest source of vehicles sold here. Thailand and South Korea were in a photo finish for second position behind Japan, each exporting more than 160,000 vehicles to Australia in 2010, with the Thais pipping their Asian competitors to the post by just 1548 units. Nevertheless, South Korea will no doubt be satisfied with knocking off Europe, which shipped 130,000 units to fall into fifth place. Australian production contributed 146,314 vehicles to the local market last year compared with 248,912 in 2005 – a decline of 41.2 per cent in six years. In the same period, supply to the Australian market from Thailand and South Korea grew 94 per cent and 107 per cent respectively. However, there is light at the end of the tunnel for domestic manufacturing.  From top: Ford Territory, Volkswagen Amarok, Great Wall Voleex. From top: Ford Territory, Volkswagen Amarok, Great Wall Voleex.Australia’s rate of decline slowed significantly between 2009 and 2010, and imminent local production of a facelifted Holden Cruze with improved engines – and a hatchback variant – should move about 30,000 cars (18 per cent) from South Korea’s tally to Australia’s. This alone might be enough for Australia to claw its way back up the charts to second position, at least temporarily. Meanwhile, the revised Territory is set to increase demand for locally-produced Fords from March and a new Australian-built Camry, planned for the end of the year, should do the same for Toyota. Japan comfortably maintained its substantial lead and made a 6.7 per cent recovery – after a significant 11.7 per cent dip in 2009 – to provide Australia with almost 366,000 vehicles. That accounted for more than a third of the total market and is almost 29,000 more than South Korea and Thailand combined. Imports from the land of the rising sun do appear to have peaked, though, consistently registering in the mid-300,000s since 2005, with an overall decline since then of 5.75 per cent. Other than an Australian comeback, what else is likely to change in 2011? In terms of Thailand’s line on the graph – given that, with only a couple of small exceptions, all Australian-delivered one-tonne utes come from Thailand – Volkswagen’s Argentinian-built Amarok threatens to put a dent in Thai imports from March onwards while Mazda recently announced that it is taking production of Australian-delivered Mazda2s out of Thailand and back to Japan. Nevertheless, the Amarok effect could be offset by the later arrival of all-new, Thai-sourced utes from Ford and Mazda and, likewise, the new Thai-built Ford Fiesta and Nissan Micra will sell in high enough volumes to negate the impact of the missing Mazda2. Thanks to the free trade agreement between Thailand and Australia that has existed since 2005, increasing numbers of vehicle manufacturers setting up in the country to build light cars (a rapidly growing category in Australia), and Ford’s plans to build the Focus there, Thailand looks set to make a habit of occupying second place, gradually encroaching on Japan’s penetration. While South Korea will lose the Cruze, this could go relatively unnoticed (or just result in a temporary blip) as two of Holden’s imported strong sellers – Captiva and Barina – are due for sales-boosting renewals this year. In addition, Hyundai and Kia show no signs of slowing and both brands have several models planned for launch this year. The figures also show that South Korea’s rate of growth as a source of Australian-delivered vehicles since 2005 has been more rapid than Thailand’s. A threat to South Korea’s traditional bargain-basement market share is China, whose 2010 figure of 6690 units is set to rise rapidly, with Great Wall planning a diesel variant and facelift for its ute, a revised X240 SUV and the launch of two passenger cars. What’s more, Chery is getting ready to launch mid-year with a three-model passenger car line-up, Geely cars are on their way and Higer is looking to hatch a HiAce competitor. The arrival of Opel later this year could boost imports from Europe – which have remained fairly static over the last six years – but momentum is unlikely to gather until 2012, when the brand should be better established with customers and its model line-up is fleshed out. Even then, Opel’s impact on European imports may well prove to be subtle, as it will be pitched to steal sales from other Euro contenders like Volkswagen.

Read more |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

|||||||||||||||||||||

Facebook Twitter Instagram