Make / Model Search

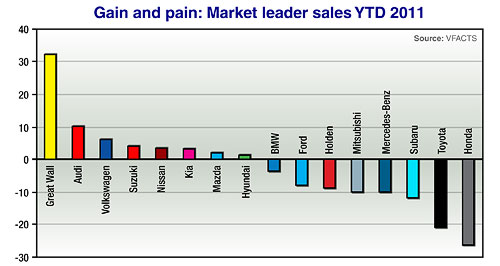

News - Market Insight - Market Insight 2011Market Insight: Industry set to shake off quakeUpward curve: Toyota's sales fortunes in Australia are set to turn around with the impending release of several new and facelifted models including the Yaris (left). A year of two halves as quake-hit car sales set to resume normal transmission8 Jul 2011 THE second half of 2011 is expected to paint a much more telling picture of the true state of Australian automotive sales than the first half. Down 6.6 per cent on the first six months of last year, the year-to-date score line has been skewed by the devastating March 11 Japanese earthquake and tsunami that crippled vehicle production of cars and parts for the best part of three months. The quake was a major contributor to market leader Toyota Australia’s 20.8 per cent plunge in volume, and rattled a few other cages as well. Even several Japanese car-makers who were ‘lucky’ to have large stocks sitting on grass in Australia when the quake hit in March experienced some shortfalls of their more popular models – shortages that persist into July. Toyota’s deficit of 22,342 units over the first half of last year accounts for about two thirds of the 34,932 shortfall in the overall Australian market, which has slipped to 496,236 vehicles – just south of the one-million-unit running rate that most pundits expected this year. It would be rash to attribute all of Toyota’s woes on the quake shortages that not only crippled its imports but forced a go-slow at its Australian Camry/Aurion plant in Melbourne. A glance back to March VFACTS sales figures reveal Toyota was running 7.3 per cent down on its 2010 tally at the end of the first quarter, when the overall market had eased 1.3 per cent.  Upcoming models: Holden Barina, Holden Cruze hatch, Ford Falcon EcoLPI, Kia Rio, Mazda3. Upcoming models: Holden Barina, Holden Cruze hatch, Ford Falcon EcoLPI, Kia Rio, Mazda3.Another contributing factor is Toyota’s ageing model line-up – an issue that is about to be addressed with a vengeance. A new Yaris and facelifted HiLux will be among the first cabs off the rank in the next three months, and then the focus shifts to the all-new Australian-made Camry late in the year. Throw in increased supply of existing models and Toyota is looking good for a big second half. Fellow Australian manufacturers Holden and Ford also have plenty to look forward to in the next six months, with Holden’s new Australian-built Cruze hatchback and Korean-built Barina in the pipeline, and Ford’s all-new Focus and – critically – EcoLPi Falcon on the launch pad. Ford has been fighting the large-car battle with one hand tied behind its back without an LPG contender this year, so the arrival of the new liquid-injected version comes none too soon for its fleet sales department. As well, we will see the full effect of the new-look Territory on Ford sales in the second half, as it only started arriving in showrooms in real volumes in June, bringing the new V6 diesel and other goodies. The full facelifted Falcon with its much-hyped EcoBoost four-cylinder engine, however, will not arrive in time to impact 2011 sales. So far this year, Ford is running closer to the average industry pace than the other two local car-makers – down 8.1 per cent – although it is coming off a lower base. Down 8.9 per cent, Holden nevertheless has been buoyed by increased sales of its locally made Cruze small sedan – up 13.4 per cent this year – that is starting to shape as a potential rival to its stablemate, the Commodore, as Holden’s – and Australia’s – top-selling car. As hatchbacks make up about half of all small-car sales in this country, the arrival of the Cruze hatch in the last quarter of the year is likely to tip the balance in the favour of the smaller sibling, especially if a fuel price spike happens any time soon. Holden’s new Barina is also shaping as a game-changer, as sales of the current model are down a whopping 52 per cent. However, the new Barina will have to be a major improvement over the smaller Barina Spark, which has struggled to light a fire under the light-car segment. Of the importers, Mazda and Hyundai continue to trade blows, with both enjoying improved sales in the first half and drawing within striking distance of Ford and third place. Mazda’s all-conquering Mazda3 small car, which last month edged ahead of the Commodore as the nation’s number-one seller year to date, gets a further leg-up with a facelifted model due in the second half. The problem for Hyundai is that its top-selling light-car, the Getz, is beginning to wilt in its run-out year, leaving it only with its less successful i20 to fend off the likes of the new Barina, new Yaris and new Kia Rio. Nissan has managed to keep its nose in front of last year’s sales performance, up 3.5 per cent, boosted by sales gains from its erstwhile small car, the Dualis, and other compact SUV, the X-Trail. But its real volume is still coming from its Navara one-tonner, which makes up a third of its sales. More than Nissan, midfield rival Mitsubishi was impacted by the quake shortages, with sales of almost all models except the Thai-built Triton ute off the boil. Its top seller, the Lancer small car, is down 22.3 per cent, and the ageing Colt light hatchback is struggling in the hottest segment in the country as it hangs on ahead of the arrival in a year or so of the replacement. The fortunes of Suzuki and Subaru could not be more different, with Subaru’s stock shortages hampering deliveries, particularly in June, while Suzuki made gains due to strong buyer support for the Kizashi mid-sizer and the low-priced, Indian-built Alto. One of the biggest movers in the market is Volkswagen, which has ridden into the top 10 on a mass of fresh metal delivered over the past year. Up 6.2 per cent, Volkswagen sales have been enhanced by improved pricing on the back of a favourable Euro-$A exchange rate, bringing aspirational European cars such as the Golf, Polo and Tiguan within reach of the masses. The arrival of VW’s Amarok ute has helped, although a global stock shortage has limited its impact to date. VW’s gain has been Honda’s pain, as the German company has been carving into the Japanese company’s traditional territory – the domain of upwardly mobile urban dwellers. The Golf has slaughtered the Civic by almost three sales to one this year, and the bad news for Honda is that its new model will not arrive until next year and even then will not have an affordable hatchback from Thailand. Honda’s response has been to slash prices and push its Thai-made Jazz in heavy advertising campaigns – a tactic that worked with an uptick in June sales. In the luxury segment, VW’s prestige cousin, Audi, has continued on its merry way with its expansion in Australia, pricing its cars to advantage to grab a sales gain of more than 10 per cent while its rivals BMW and Mercedes-Benz have both slipped against last year’s tally. All of these glossy German marques have major new-model activity happening now or soon, and this battle looms as one to watch between now and December 31. Although they will not necessarily admit it, bragging rights between these three rivals is as hotly contested as anything anywhere else in the market. And note that Alfa Romeo is up 20.6 per cent year to date, and, in the low-volume upper echelons, Ferrari has climbed 52.2 per cent, Porsche 38.1 per cent, Rolls-Royce 57.1 per cent and Bentley 20.0 per cent. At the other end of the market, one of the biggest movers has been Chinese ute and SUV marque Great Wall Motors with a facelifted range. Its sales are up 32 per cent in 2011, even though it offers only limited models without diesel or automatic transmission variants. That growth will be boosted with the imminent arrival of diesel in the ‘V’ ute and ‘X’, ranges. With several other Chinese ute-makers, including Foton and ZXAuto, signalling their intention to enter the Aussie arena, the Chinese threat is becoming apparent in the sales graphs. Isuzu Ute, which relies on just the D-Max utility, has also experienced strong growth in 2011 YTD, with several record sales months in the first half to be 30.7 per cent up on last year. SsangYong, too, has pushed ahead to be 29.2 per cent ahead YTD. Of the vehicle makers on the edge of the Australian top 10, Kia – with a rise of 3.3 per cent in sales thus far in 2011 – has the potential to push deepest into the mass market end this year, although as we have reported, vehicle supplies (limited by bigger demand in higher-volume markets rather than from the Japanese earthquake) are heavily restricted. Supplies of the Rio light car are expected to dry up before the new-generation model arrives in showrooms in September, though Kia Motors Australia is pushing to “up-flex” supply across its range in the final quarter. Among the smaller importers plying their trade in the Australian market, Renault has been a standout with a creditable 75 per cent increase in sales from a small base. Although numbers are still relatively small, its Megane hatch and Fluence sedan small-car twins have relit the flame for the French company in this market. The 410 cars Renault delivered in June were almost 300 per cent up on June last year, making this its strongest sales month in eight years. Skoda and Land Rover has also had some joy, up 47 per cent and 18.7 per cent respectively, while Volvo has gained 14.4 per cent. Dodge is up 36.1 per cent YTD, while Fiat is up 4.9 per cent.  Read more |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

Facebook Twitter Instagram