Make / Model Search

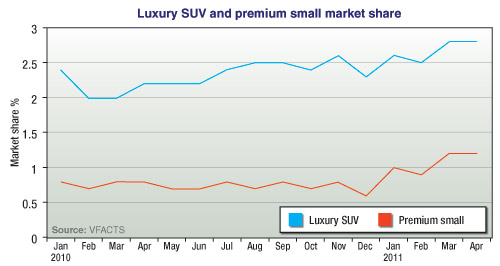

News - Market Insight - Market Insight 2011Market Insight: Premium products outperform marketMaking a splash: A redesign of Jeep's Grand Cherokee has helped improve the model's sales by 346.1 per cent so far this year. Premium small cars, luxury SUVs streak ahead in Australia's slower 2011 sales race6 May 2011 AUSTRALIA’S new vehicle market may have cooled even further last month, but the popularity of premium small cars and luxury SUVs continues to boom. While the industry has shrunk by 3.2 per cent overall to May this year, sales of small cars priced over $40,000 have increased by 35.5 per cent year to date and luxury SUV sales are up 15.5 per cent. The Australian appetite for a bit of luxury is also borne out in premium light (up 45.6 per cent), upper large over $100,000 (up 9.5 per cent) and premium people-movers (up 110.2 per cent), although volumes in these sectors are small enough for fleet orders or new model launches to cause anomalies. At the same time, sales of premium mid-size and large cars and sportscars over $80,000 and over $200,000 have all declined so far this year and, as a whole, the premium passenger segment (not including luxury SUVs) is down 0.2 per cent YTD. But against the overall market’s 3.2 per cent slowdown so far this year, the fact remains that the premium passenger segment is outperforming the wider market.  From top: Audi Q7, Porsche Cayenne, Mercedes-Benz B-class, Lexus CT200h. From top: Audi Q7, Porsche Cayenne, Mercedes-Benz B-class, Lexus CT200h.And the upward trend towards these types of vehicles when compared against the current downwards trend of the total industry is translating to a steady increase in market share. The premium small and premium light segments are gaining popularity as customers realise they can obtain luxury features and a prestigious bonnet badge – not to mention better fuel economy and more promising resale value – for the price of an ordinary medium-sized or large car. Despite the decline of a number of key players, compact SUV (up 8.1 per cent YTD) is the only mainstream segment to be up so far this year, and dealers are reporting strong sales of higher-priced variants within many model ranges. In the luxury SUV segment, which encompasses vehicles of all sizes ranging from BMW’s compact-sized X1 crossover to the gargantuan Mercedes-Benz GL-class, there is a lot of choice for people downsizing from a large SUV, upsizing from a family car or moving from the traditional luxury sedan or wagon – and there have been some big winners in this category so far this year. Luxury SUVs can represent a lot of car for the money. The popular Audi Q7, for instance, is available with the same 4.2-litre, twin-turbo V8 diesel engine and smooth eight-speed transmission as the A8 limousine flagship for $127,814, whereas the A8 with an identical drivetrain is priced at $234,500. No wonder then that with 633 sold YTD, Q7 sales are up 65.7 per cent, doubtless helped by the arrival last September of a revised engine and transmission line-up that resulted in higher performance and increased fuel efficiency. The new Jeep Grand Cherokee, launched at the beginning of February, has gone gangbusters with a 346.1 per cent increase in sales so far this year, having sold 455 units. April was a slow month for the big Jeep though, falling to just 47 units from 202 sales in March, so it is one to watch - especially with the all-important diesel variant (diesels account for a large proportion of luxury SUV sales) scheduled for June. The new-generation Porsche Cayenne launched last July is this year’s luxury SUV success story, having sold 276 units so far for a whopping 91.7 per cent rise compared with last year. The success looks likely to continue for, as GoAuto has reported, Australian-delivered Cayennes benefit from a tweaked diesel engine and optional power upgrade for the turbo variant from around August. Land Rover is having a good year too, the refreshed Range Rover and Freelander launched in February helping the British off-road brand to achieve a 1865 sales in the first four months – up 22.1 per cent. The aforementioned Range Rover is up 15.8 per cent and the Freelander is riding a 44.1 per cent boost in sales. The Range Rover Sport is also up 32 per cent. Monthly sales of BMW’s X1 have slowed a little after the initial excitement following its April 2010 launch but it remains the Munich marque’s third best seller after the 3 Series and X5. The thoroughly redesigned X3 – which went on sale in March – is also having an effect, with sales up 12.9 per cent at 403 so far this year. The trend behind the luxury SUV segment is clearly linked to new model action and the proliferation of compact luxury SUVs looks likely to further increase sales by making the segment more accessible and attractive to downsizers or even regular passenger car owners. More new blood in the form of Range Rover’s hotly-anticipated Evoque due around October and the Audi Q3 set for the first quarter of 2012 looks set to keep up the momentum. In addition, the Volkswagen Touareg is set to be replaced in the third quarter of this year and Saab’s 9-4X is expected to arrive by early next year. In the premium small car segment, booming sales of the Mercedes-Benz B-class (up 51 per cent) and a successful launches of the Lexus CT200h hybrid hatch (398 sales) and Alfa Romeo Giulietta (167 sales) have contributed to this year’s success story. Mercedes’ strategy of dropping the A-class from its Australian line-up and sprucing up the B-class with a new 1.7-litre petrol engine and increased standard equipment at the beginning of last year has paid dividends. It has consistently recorded triple-digit monthly sales ever since, regularly selling in excess of 200 units as opposed to its previous norm of occasionally nudging over a hundred units in a good month. Although the BMW 1 Series is down 14.3 per cent YTD, it is due for a comprehensive overhaul around September and will be joined in the segment around December by Citroen’s DS4.  Read more4th of May 2011  Ford will rebound, says CarrFederal minister predicts Ford Australia’s new models will reverse sales slump4th of May 2011  VFACTS: Ford Falcon languishes in slow AprilCommodore outsells Falcon two to one as Hyundai moves back into third place |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

Facebook Twitter Instagram