Make / Model Search

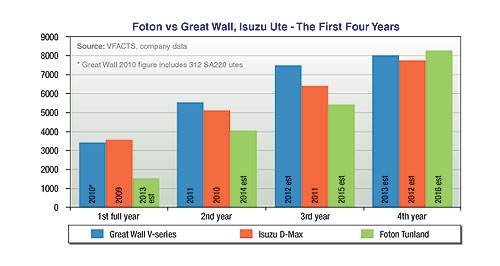

News - Market Insight - Market Insight 2012Market Insight: Foton’s road aheadBig question: Tunland’s large physical dimensions and Cummins-sourced diesel are unique selling points, but is it enough to justify a premium price over other Chinese utes? Foton follows path of Great Wall, looks to Isuzu Ute in quest for Australian success3 Dec 2012 By TERRY MARTIN AS THE newest Chinese auto-maker to arrive in Australia, Foton is facing up to the challenge of introducing a new brand and unfamiliar model to the marketplace, and convincing buyers to switch from long-established nameplates. With the Tunland now on sale, Foton has entered a fast-growing and potentially lucrative segment in the 4x2 and 4x4 dual-cab utility market, which draws large numbers from both commercial fleet and owner-operator business customers, and an increasing number of private recreational buyers. But starting from scratch is a tough ask and, quite apart from building a comprehensive national dealer network, Foton Automotive Australia must build a strong case to consumers for its Chinese model against respected brands and cheaper rivals. The manufacturer and its local importer are banking on key selling points such as large physical dimensions and a Cummins-sourced diesel engine providing the cut-through Tunland needs, considering the ute is priced upstream of Great Wall Motors’ V-series but below big-name players such as the market-leading Toyota HiLux. As GoAuto has reported, Foton aims to sell 1530 Tunlands here next year, expanding to 4050 units in 2014, 5430 units in 2015, 8520 units in 2016 and 10,520 in 2017. More body derivatives, a petrol engine, automatic transmission and increased safety technology are all anticipated and will be vital for the company to achieve those numbers, which in the first few years at least are similar to those achieved by Great Wall.  From top: Foton Tunland Great Wall V240 ZX Auto Grand Tiger Isuzu D-Max. From top: Foton Tunland Great Wall V240 ZX Auto Grand Tiger Isuzu D-Max.Distributed by Ateco Automotive, Great Wall launched in June 2009 with the SA220 and V240 and along the way has experienced setbacks including safety recalls, a sub-standard two-star ANCAP crash-test rating for both vehicles and, after slow sales for a year, the discontinuation of the entry-level SA-series. However, sales have grown steadily on the back of new V-series derivatives and, according to Ateco, “paying attention to the fundamentals” such as pricing, incentives and perceived value for money across the model range. It sold 1643 V-series and SA utes in the 2009 opening stanza, climbing to 3420 in its first full year on sale (with just 312 of those SA220s) and rising further in 2011 with 5555 new registrations. This year, sales had passed 6500 to the end of October, and should comfortably reach 7500 by December 31. The company has forecast only modest growth in 2013, to 8000 units. While another new Chinese ute, the ZX Auto Grand Tiger, is scheduled to arrive early next year, the other obvious benchmark brand for Foton is Isuzu. Isuzu Ute Australia launched in October 2008 after a formal separation between Isuzu and General Motors led to Isuzu taking its own course with the D-Max – a model that Holden previously had the rights to sell here as the Rodeo. The established ties with a popular, proven model – and the ongoing association with Holden’s subsequent Colorado – clearly made selling the unfamiliar D-Max here an easier proposition than an untried Chinese ute. But IUA has still had to work hard to build up a solid following for the D-Max, which has competed head-to-head in the marketplace against the big names – HiLux, Navara, Triton, Ranger, BT-50 and the mechanically similar Colorado. From the 273 units it sold at the end of 2009, IUA achieved 3566 D-Max sales in its first full year, climbing to 5114 in 2010 and 6397 last year, the latter impacted by supply interruptions stemming from the Thai floods. Despite the delayed showroom arrival of the redesigned D-Max, which was finally launched in July, D-Max sales are up 17.3 per cent this year to 6228 units at the end of October, putting IUA on course for more than 7500 sales – right alongside Great Wall Motors. The company has indicated to GoAuto that it should finish the year between 7800 and 7900 units, with further growth next year pushing sales up to between 9000 and 10,000 units. The latter will depend to some extent on fleet sales in the mining sector. Foton Automotive Australia will doubtless be studying the actions and sales performance of all its competitors, but Isuzu Ute holds special significance given its recent history, close ties to the Queensland market, Tunland’s close positioning to D-Max and, not least of all, the fact that FAA’s new national distribution development and operations manager, Paul Vuko, was previously in charge of sales and dealer operations at IUA. Isuzu Ute is also preparing to expand its brand with a D-Max-based seven-seater SUV, something Foton likewise plans to achieve with a Tunland-based wagon from 2014.  Read more14th of November 2012  Foton maps out Australian expansionSales targets and future model plans on the table for Foton and distributor FAA13th of November 2012  First drive: Foton shoots for the stars with Tunland uteAustralia gets new Chinese brand with the launch of the Foton Tunland dual-cab18th of October 2012  AIMS: Isuzu confirms SUV for Oz in 2013Seven-seat, D-Max based Isuzu SUV heading to Australia next year – with new styling14th of August 2012  ZX Auto set to land GrandTigerClaws out in Chinese ute battle with October launch of ZX Auto GrandTiger in WA20th of June 2012  First drive: Isuzu launches all-new D-Max uteAll-diesel Isuzu D-Max one-tonner to go on sale July 2, priced from $27,20010th of May 2012  Great Wall going strong as small car approachesChinese brand Great Wall to keep growing with dealer expansion and new products |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

Facebook Twitter Instagram