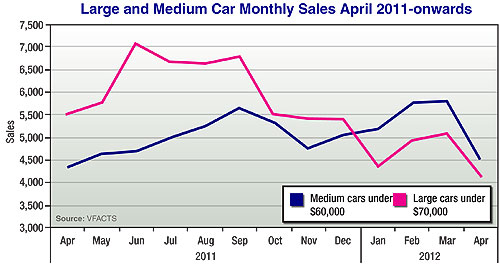

News - Market Insight - Market Insight 2012Market Insight: Rethinking the term ‘large’Rethinking large: The trio of locally-built large cars - including the Holden Commodore - are all down in sales again so far this year. Local large cars still in spotlight as sales trough deepens and sector restructures4 May 2012 By TERRY MARTIN AS SIGNIFICANT new models hit the market, and new taxpayer-supported investments are made to keep Australian car manufacturing alive, the monthly sales figures continue to dent the long-term prospects of locally built large cars – at least as we know them today. New-vehicle registration statistics released this week by the Federal Chamber of Automotive Industries (FCAI) show yet another fall in the large-car segment, down 25.4 per cent in April to account for just 5.2 per cent of the entire market. For the year to date, large cars below $70,000 have now fallen 23.2 per cent, on the back of the three Australian-built nameplates all plunging more than 20 per cent. Ford’s Falcon is down 25.4 per cent (plummeting 30.7 per cent last month with just 1009 sales, fewer than the Territory SUV), Holden’s Commodore is 22.8 per cent in arrears (down 26.9 per cent in April on 2248 sales, again behind the Cruze small car) and Toyota’s Aurion has fallen 20.8 per cent, despite an even-par 0.3 per cent rise (629 units) last month with registrations of the redesigned model kicking in. Although Cruze sales dropped 10.3 per cent last month and sales of the medium-sized Toyota Camry were up just 1.6 per cent, their respective YTD increases of 4.9 and 17.0 per cent are at least heading in the right direction in market segments that are bigger than the once-dominant large cars.  From top: Ford Falcon, Toyota Aurion, Holden Cruze, Chevrolet Malibu. From top: Ford Falcon, Toyota Aurion, Holden Cruze, Chevrolet Malibu.Yes, even medium-sized cars – up 19.8 per cent YTD in the sub-$60K class – have outsold large cars throughout this year in a segment showing strong growth potential, which is one of the reasons Holden has signalled it will downsize after the 2013 VF series with its next-generation ‘Commodore’. Toyota has also spoken of its “firm intention” to build another all-new Camry that would take it into next decade, leaving Ford as the only other local car-maker still to give a manufacturing commitment beyond 2016 and the current platform underpinning Falcon sedan/ute and Territory. So the spotlight remains on Australian-built large cars, which last month brought the long-awaited four-cylinder Falcon and new-generation Camry-based Aurion, following Holden’s first dedicated-LPG Commodore/Caprice in February and, late last year, Ford’s FGII Falcon series upgrade. The Blue Oval’s much-vaunted EcoLPi LPG Falcon was launched in July last year – almost a year ago – but has not arrested the downturn in Falcon sales. LPG supplier issues have reportedly played a part here, but Ford and Holden management will be clearly dismayed at the apparent lack of buyer interest in their respective new LPG models, which have required major investments and offer clear benefits for motorists. Last month, the Australian industry as a whole managed only 20 sales to private buyers of passenger cars with dedicated factory-fit LPG, and 205 fleet/rental sales. Ute LPG sales tell a similar story. Unsurprisingly, Ford has taken a cautious approach with the sales prospects of its four-cylinder Falcon, targeting just 250 new registrations a month. Holden, too, has been guarded in how much impact the forthcoming VF series will have on Commodore’s place in the market overall, but chairman Mike Devereux recently stressed that “I wouldn’t be investing literally hundreds of millions of dollars in the VF Commodore if I didn’t believe in the large-car segment”. Indeed, while the segment’s sustained downturn and this year’s sharp decline are striking, Australia’s three local car-makers have all spoken of its underlying strength – the expectation that there will always be a healthy demand for large sedans, albeit at a much lower point than at times when there were high import tariffs and much less choice in the market. Likening it to the SUV market in the US, Mr Devereux argues that Australia’s large-car decline was inevitable given the influx of competitors across the entire industry, which in turn has made comparisons with a decade ago – when Holden was selling more than 80,000 Commodores, twice as many as it does now – irrelevant. “Ten years ago, there were 144 different kinds of cars sold in this country today there are over 230,” he says. “Even if there wasn’t a decline in large cars, we’d be selling fewer large cars because there is more choice. “Make no mistake, when there’s almost twice as many competitors in a market, you can’t help but see a decline in what you do. No car company is ever going to be seven or eight per cent of the Australian market ever again with one model. “It doesn’t happen anywhere on the planet and it will not happen in Australia.” Toyota Australia executive director of sales and marketing Matthew Callachor said at the recent Aurion launch that the large-car market was still “substantial and vital to the success of the total Australian market”. And while Ford Australia president Bob Graziano recently told GoAuto at the Falcon EcoBoost launch that the company was still considering its manufacturing future beyond 2016, Ford Motor Co top brass – from CEO Alan Mulally down – have vowed to continue selling a large-style sedan here for many years to come. For its part, Holden confirmed in March that it will build its VF Commodore successor here on a new global GM platform. Details are still to materialise, but when pressed on what this might be, Mr Devereux talked up the small-car segment (covered by Cruze) and the “powerhouse segment” of medium-sized cars in the US. “Our goal with VF is to stem that (sales) decline and then, frankly, figuring out what that vehicle larger than a Cruze or a Corolla or a Mazda3 looks like for Australia, is part of the magic of the auto industry,” he said. “Do I think there’s a future for cars bigger than Cruzes and Corollas? Absolutely. And I think there will be some innovation both in the size and contenting of those (large-car segment) vehicles going forward that makes them very viable and very relevant for Australians.” Asked specifically whether he believed in the future of cars bigger than the Camry or the forthcoming medium-sized (imported) Malibu, he said: “I’m not going to go down that path because, frankly, we think we’ve got a pretty smart plan and it’s going to take three, four, five years to execute that plan and maybe, in 2015 or early 2016, I might start to answer that question.” Whether this is Malibu, Impala, a reborn Torana or, more likely, just a downsized Commodore, there are all sorts of possibilities for Holden’s next-generation larger-sized car. And the result, just as what transpires from Ford and Toyota, is sure to divide opinion, stir the market and keep the local manufacturing sector on a knife-edge.  Read more24th of April 2012  Ford Falcon EcoBoost on slow burnBlue Oval sets the sales bar low for Falcon EcoBoost’s first seven months17th of April 2012  Toyota targets 22 per cent growth in 2012Comeback to 230K sales is Toyota Australia’s target as locally-built Aurion lands22nd of March 2012  Billion-dollar deal firms Holden future to 2022$275m government funding sees Holden commit to building two all-new global cars13th of March 2012  Toyota's “firm intention” to stay until 2021Altona factory guns for next-generation 2016 Toyota Camry, despite current troubles16th of January 2012  Market Insight: Dice rolls for large car nicheDawn of new year brings future of Australian car manufacturing into question – again |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

Facebook Twitter Instagram