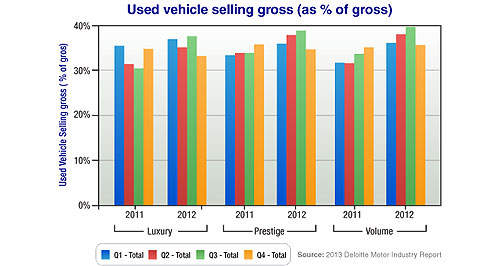

News - Market Insight - Market Insight 2013Internet eating into dealer profits: studyLoss lot: Many dealers are losing money on their used car operations with potential customers chosing to shop online. Car dealers need to raise margins in used cars and parts and servicing operations29 Apr 2013 By IAN PORTER NEW vehicle dealers will have to counter the undermining effects of the internet if they are to improve the profits from their used vehicle operations and their parts and service departments. Leading car industry services provider Deloitte believes dealers will have to reduce their dependence on finance and insurance income as the incentives and stimulus that have provided record vehicle sales in 2012 may not continue. “For dealers the game is changing,” said Deloitte Motor Industry Services lead partner Danny Rezek. “They are having to accept that, in the intensely competitive Australian market, new vehicle profit margins will be lower than before and they need to look to ways of offsetting this.” The sad reality is that, just like with new cars, the majority of dealers are still losing money on their used car operations, Mr Rezek said. However, a minority do make some money on used cars. The results of Deloitte’s 2013 Motor Industry Report show that, overall, returns from the used car lot did improve a little in 2012, to the point where, on average, dealers made 1c in the dollar selling used cars. “While one of the factors contributing to this was improved gross margins in 2012 over 2011, it is also not a surprise to see that the best quarter for used car operations in 2012 was the quarter immediately following the record new car month of June,” Mr Rezek said. “The extremely high volumes of customers that passed through new car showrooms in this period provided dealers the opportunity to access fresh stock in quantities that they had not seen in some time.” But the overall trend in used sales is downwards when compared to new vehicle sales, Mr Rezek said, which is due largely to the internet. Three years ago, dealers used to sell three used cars for every four new. In 2012 it was down to two used for every four new. “While gross margins per used unit held up reasonably well over this time, the drop in overall volumes moving through the used vehicle departments of the average dealer put pressure on used vehicle selling grosses,” Mr Rezek said. This is explained by the greater use of online classified sites by consumers rather than offering them up as a trade-in. “An analysis of vehicle transfer details in NSW shows that in 2000 the private-to-private market for used vehicle transfers made up 45 per cent of all used vehicle transactions in the state,” Mr Rezek said. “By 2012, the private-to-private market had climbed to over 60 per cent of used vehicle transactions, with much of this increase happening since 2008. “During the same timeframe the dealer-to-private share of vehicle transfers fell.” The internet is also playing against dealers in terms of what they can charge for a vehicle. “The internet continues to have another impact on used vehicle operations through the improved flow of pricing information throughout the marketplace,” Mr Rezek said. “Today the market price of a vehicle is more readily known through internet databases than ever before and, in price sensitive markets, it is becoming increasingly difficult to find ways to market a specific vehicle so that it generates a premium for the seller.”  Left: Deloitte Motor Industry Services lead partner Danny Rezek. Left: Deloitte Motor Industry Services lead partner Danny Rezek.To counter this, some dealers are promoting their inherent strengths in the used trade. They are highlighting factors such as convenience, wide choice of vehicles, security of title, buying in confidence, the provision of extended warranties and access to highly trained and experienced mechanics, Mr Rezek said. While the margins at the front end of the dealership are under attack from manufacturers’ incentives on new vehicles and the internet’s effect on used car prices, earnings from the reliable, steady-as-she-goes back-end are also under pressure. “Vehicle service intervals have lengthened, standard repair times have shortened, parts are replaced rather than repaired, vehicle ownership cycles have shortened, and competition from non-franchise service providers has intensified,” he said. All this has diminished the earnings potential of the service department, previously a stable source of revenue and profits. Mr Rezek points out that the biggest change in servicing in recent years has been the introduction of capped-price servicing, a program designed to counter the perception that franchised dealers are expensive. “Toyota was the first large brand to adopt such a program. The Toyota Service Advantage program has now been operational for some years and dealers claim their customer retention rates for three-year-old vehicles has risen from around 50 per cent to well over 80 per cent.” But he points out that the typical dealer, with average customer retention and no ability to charge a premium in the workshop, will have to find ways to stay in touch with its customers to raise retention under a capped-price system. “Not all operators either understand this or are successful at it,” he said. Dealers must have a defined customer relationship management and retention strategy. “Dealers make more gross profit from, and spend less on, repeat and referral customers. Do they have the customer retention processes in place to make this happen.” Mr Rezek said some dealers have attacked the problem of falling service demand by trying to reverse the out-sourcing phenomenon that has seen a range of services released to independent operators over the decades. “Many dealers are once again starting to provide a more complete range of automotive services including tyres, wheel alignment, even full panel repair workshops, not only to provide additional income sources but also to try and maintain more regular contact with their customers and thereby improve customer retention.”  Read more |

Click to shareMarket Insight articlesResearch Market Insight Motor industry news |

Facebook Twitter Instagram