Make / Model Search

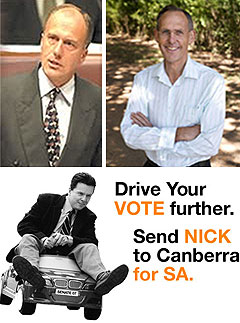

News - General News - FinanceLCT compromise on the cards as sales plummetAround the Benz: Luxury car importers say the higher tax could have long-term ramifications for the Australian car industry. Negotiations with minority groups continue as senate luxury car tax decision looms2 Sep 2008 THE federal government’s controversial proposed luxury car tax increase is riding on a knife-edge tonight, just hours before official sales figures are expected to reveal a further downturn in the Australian new-car market in August. Key senators are negotiating with the government and today even keen Canberra observers were not prepared to predict which way the debate will go, with a vote expected to take place tomorrow (Wednesday) or Thursday. VFACTS data for August to be published tomorrow morning are expected to show an overall decline in the market and an especially depressing result for the luxury car segment, which one industry insider described as “disastrous”. The figures will put even more pressure on the government to soften its proposed tax hike (from 25 per cent to 33 per cent) before being put to the vote in the Senate, where two independent senators and five Greens hold the balance of power. Crucially, the Coalition announced on Thursday that it will oppose the legislation, so the government requires the support of all of the other seven senators to pass the new LCT, which was controversially announced in the May federal budget without any warning or industry consultation. Coalition senators last week slammed the government move, saying it is “based on naked class warfare and the politics of envy”. But the critical votes are in the hands of the Greens and independents Nick Xenophon and Steve Fielding – any one of which can scupper the legislation or force amendments. Although Senator Fielding has not revealed his position on the issue, Senator Xenophon and the Greens have expressed concerns about the LCT and indicated that modifications may be required to pass the legislation. Greens leader Bob Brown said he would try to get the bill redrafted so that it focused on “gas guzzlers”.  Left: Shadow industry minister Eric Abetz, Greens leader Bob Brown and Senator Xenophon (in his 2007 election campaign). Left: Shadow industry minister Eric Abetz, Greens leader Bob Brown and Senator Xenophon (in his 2007 election campaign).“We want the bill made climate-friendly,” said Senator Brown told ABC Radio at the end of last week. “If you’re going to tax people, tax the gas-guzzlers, that’s what it comes down to. “Barring any talks in the meantime, (Greens Senator) Christine Milne will be moving in the Senate to have the government withdraw the bill and redraft it to make it climate-friendly.” The Greens appear to have embraced a recent Mercedes-Benz proposal, with Senator Milne proposing that the government phase out the LCT and instead introduce a carbon tax on all vehicles to encourage fuel efficiency. “The Government needs to be consistent if it wants to be a leader on climate change, if it wants to reduce dependence on foreign oil,” said Senator Milne. “If it wants to build competitive advantage in Australian car manufacturing for green cars, then the best way of doing it is to look at the vehicle fuel efficiency of our fleet and make sure the tax system drives the right outcome.” Senator Xenophon, meanwhile, told reporters that the LCT legislation “is not doomed it just needs some major surgery”. In the Senate last night, the South Australian senator officially weighed into the debate with a speech in which he expressed serious concerns over specific aspects of the legislation. He also revealed that he has had discussions with the government and that he expects a response to his concerns, especially with regard to raising the $57,180 threshold. “I had the benefit of further discussions with the government today in relation to this legislation and I raised my concerns,” Senator Xenophon told Monday night’s debate. His main concern is over the threshold at which the LCT comes into effect, which has increased only marginally in the last two decades, resulting in 12.0 per cent of cars being captured under the tax last year compared to only 4.5 per cent in 1986. The car industry universally opposes the LCT but says that, at the very least, the threshold should be raised considerably to reflect inflation and avoid the luxury car sales crash of 1990 that forced the then Hawke government to drop changes it had hoped would boost Treasury coffers. Senator Xenophon warned the government to “bear that lesson in mind” when considering the consequences of the LCT legislation. Mercedes-Benz Australia spokesman David McCarthy said that its sales have already slumped from more than 1500 per month to only about 1000 in August and that, even if a 20 per cent drop across the luxury car market was maintained over the next three years, it would more than negate any increase in government revenue. “There’s really nothing in that report to substantially support an increase in the tax,” Mr McCarthy told GoAuto. “I don’t think it will deliver any revenue and it’s going to have some unintended consequences in terms of investment and employment. This level of sales is not sustainable and is fundamentally changing the business equation.” Mr McCarthy said it could prevent or delay the introduction of new high-tech, low-emission vehicles to Australia in the future because reduced volumes would make it harder to justify the cost of right-hand drive production and local validation. The Labor-dominated Senate Standing Committee on Economics review, which was forced on the government by the previous Coalition-controlled upper house, handed down its report on Thursday and predictably supported the legislation – despite the fact that all 29 witnesses and 18 written submissions rallied against it. The committee said it was reasonable for high income earners to wear higher prices because they had benefited the most from income tax cuts and the resources boom. It also argued that, while only cars attract a luxury tax, this could be justified somehow, and it was easier to increase the LCT because it already exists rather than introduce new taxes. “The committee sees some merit in the argument that it is ‘unfair’ that luxury cars are taxed but not other luxury purchases such as yachts or expensive artworks and jewellery,” said the senate report. “However, as there is already a luxury cars tax, there are less administrative and compliance costs in increasing it, rather than introducing new taxes on other luxury goods.” Nevertheless, the committee indicated that more wide-ranging luxury taxes could be introduced following the current review of Australia’s tax system by Treasury chief Ken Henry. Attached to the ‘majority report’ was a ‘Dissenting Report from Coalition Senators’ that rejected the LCT increase, saying that it would take the Australian car industry “from protectionism to discrimination”. Noting a 30 per cent downturn in sales of luxury vehicles, it said: “If this downturn is reflected for the remainder of the year there is a very real possibility that the proposed eight per cent tax increase, if passed into law, will actually result in a decline in Government revenue. “The Rudd Labor Government has put forward no sensible policy rationale for this tax increase on cars other than it being a naked grab for cash.” One of the opposition senators, shadow industry minister Eric Abetz, said the increase was “punitive” and would damage the Australian automotive industry. “Labor’s only rationale for this tax increase is to increase revenue and supposedly fight inflation – yet even Labor senators concede it will be inflationary in their majority report,” said Mr Abetz. “Labor says they want to look after Australia’s car industry, yet they are proposing a tax increase which will damage it. “Labor says they want safer, ‘greener’ cars, yet they are proposing a tax which will discourage innovation in these areas. “Labor says this is a tax on the ‘rich’, yet the highest-selling so-called luxury car is the Toyota Landcruiser, which retails for around $70,000 and are driven primarily by those in rural and regional Australia and those with the need for a ‘people mover’. “Labor’s Luxury Car Tax surcharge is a tax grab based on the politics of envy. It is bad policy and it will be opposed by the Coalition.” Federal Chamber of Automotive Industries chief executive Andrew McKellar today described the dissenting report as “more substantive” than the majority report and renewed his attack on the LCT. Mr McKellar told GoAuto that the slowing down of the economy was starting to hit car sales generally, providing more reason for the government to reconsider the damaging LCT increase. “It’s very difficult to say how it will play out (in the senate), but we remain concerned about the impact that the tax increase will have on the market as a whole and in particular on those segments at which it is targeted,” said Mr McKellar. “There are clear signs that past interest rate increases and the more general slowing of demand in the economy is now feeding into the new car market, and this tax increase only serves to compound that. That’s all the more reason for the government to reconsider what it is proposing and contemplate the impact that it’s having on the industry. “At this stage it’s quite a fluid situation and there’s obviously discussions going back and forward between the major groups in the senate, but it’s just too hard to call what the outcome will be.” Last week, in response to the senate committee report, Mr McKellar said that pushing ahead with the tax increase would hurt the Australian economy. “This proposed tax hike is economically irresponsible and will hurt the Australian car industry,” he said. “We are concerned that this retrospective tax increase will compound the significant competitive challenges faced by local car-makers and the broader automotive industry. Vehicle manufacturers are united in their opposition to this tax rise.” Should the retrospective aspect of the legislation pass through the senate, the Victorian Automobile Chamber of Commerce has signaled a possible legal challenge to the Australian Tax Office ruling on backdating the tax to July 1. The VACC says it has legal advice that “the approach that would ultimately be adopted by a court is not clear, or at least not as clear as the Commissioner suggests”. Read more:Senate hears final LCT pleasLCT battle enters final phase |

Click to shareGeneral News articlesResearch General News Motor industry news |

Facebook Twitter Instagram